Banking Law Endorsement and its types ENDORSEMENT AND TYPES OF ENDORSEMENT I INTRODUCTION A

Contents:

In this situation, the seller would assume all of the risks if the buyer is unable to pay. So the seller could request that the buyer receive a bank endorsement from their bank. A bank endorsement is a bank’s guarantee that they will honor a financial obligation made by their customer even if the customer can not pay. The endorsee under a restrictive endorsement gets all the rights of an endorser except the right of further negotiation.

In this case, you are signing over a check made out to you to someone else. You first write “Pay to the order of” followed by the name of the person who you wish to have the funds. A number of banks will no longer accept such an endorsement, so make sure in advance that your bank will. And even if it will, it may require you to be present for identification purposes when your third party cashes or deposits the check. If this seems like an insecure way to send money, that’s because it is. It can be a good idea to accompany this person to the bank to provide proof of identification, because banks frequently won’t accept checks endorsed in this way unless the payee is present.

Providing assistance to the regrouped population may be regarded as a sign of support or endorsement of the regroupment policy. The bank requires that someone witness the endorsement of the check. You may need an endorsement if you have items of value, or if you’ve experienced a change to your home or business. It’s a good practice to review all your policies each year to ensure that they meet your current needs. Your agent can assist you in assessing whether you need an endorsement or a different type of policy.

What Is Pay to Order? How It Works, Forms, and Benefits – Investopedia

What Is Pay to Order? How It Works, Forms, and Benefits.

Posted: Sun, 26 Mar 2017 04:43:27 GMT [source]

Essentially, a banker’s acceptance or time draft is a negotiable document where a bank unconditionally agrees to fulfill a payment obligation on behalf of the customer that created it. A just isn’t solely reinstated in his former rights but has the rights of an endorsee towards B and C. An endorsement is ‘special’ or in ‘full’ if the endorser, in addition to his signature also point out the name of the person to whom or to whose order the cost is to be made.

Insurance Endorsements

Suppose Nick issued a check for his son, Jim, to help him meet some urgent expenses. The former put his signature on the check correctly, and the latter endorsed the check with his signature only. It means that if Jim misplaces it and it falls into the wrong hands, Nick can lose his funds to an unknown person. Endorsing negotiable instruments is not always necessary for their transfer. For example, one does not need to endorse commercial paper if it is bearer paper. Therefore, in this case, the voidable and involuntary transfer can constitute negotiation.

- You also don’t have to worry about your checks getting lost or stolen.

- In this instance, the exporter would receive the bankers acceptance and be allowed to cash the money in at a future date.

- However, an endorsement for the part amount of a negotiable instrument does not operate as a legally valid endorsement.

- Your chosen recipient would then have to sign their name beneath yours before depositing or cashing the check.

- Negotiable refers to the price of a good or security that is not firmly established or whose ownership is easily transferable from one party to another.

Another form of bank endorsement occurs when a receiving bank stamps a check. For instance, if you were cashing or depositing a check into your bank account. A bank endorsement signifies to a seller that a negotiable instrument will be honored when presented to the customer’s bank for collection, provided that all terms of the transaction agreement are met. A bank endorsement is a guarantee given by a bank or credit union.

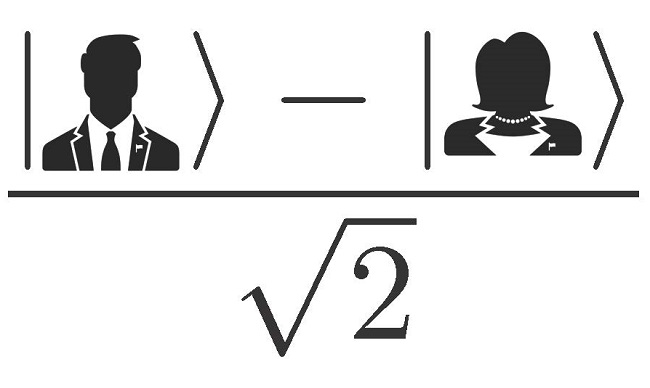

Multiple Payees

An alternative explanation is that the gender difference in endorsement of symptoms is the result of response bias. But with strategic voters this is not true because for some local candidates, the endorsement constraints may not be binding. The consensus achieved is, therefore, not an accident of compromise or a fortuitous coincidence but a genuine endorsement from all involved. Nowhere was his endorsement of female culture more visible, or more spectacular, than in his attire. Yet it was more than an endorsement for these patrons of southern renewal and progressive thinking.

A transferable letter of credit is one that grants a primary beneficiary the right to transfer some or all of the credit to a secondary beneficiary. A sight draft is a type of bill of exchange, in which the exporter holds the title to the transported goods until the importer receives and pays for them. Sec 15 of the Negotiable Instruments Act 1881 defines the term ‘endorsement’.

The particular person to whom the instrument is endorsed is known as the endorsee. In this instance, the exporter would obtain the bankers acceptance and be allowed to money the money in at a future date. The importer would want to pay the bank back before the maturity date.

VIDEO: Donald Trump booed at Arizona rally over Congress endorsement – Business Insider

VIDEO: Donald Trump booed at Arizona rally over Congress endorsement.

Posted: Sat, 23 Jul 2022 07:00:00 GMT [source]

If you’re doing a blank endorsement, sign the check just before you deposit the check. One is that certain kinds of electronic checks don’t need to be endorsed, at least not in person. A second is that certain banks offer a service whereby they will deposit a check with no endorsement. However, there is usually a longer wait before the funds clear, and you will likely have to confirm your identity.

endorsement | American Dictionary

Common financial institution endorsements include banker’s acceptances and letters of credit score. Special endorsements enable a payee to make a check payable to another person. In this case, the verify may be cashed and paid to the required individual.

If you’ve received a check, you probably want to cash or deposit it as soon as possible. Writing a FBO check helps to ensure that the funds will be used for a specific purpose, but in this case, the assisted living facility is considered as the custodian of the funds. Restrictive Endorsement tries to end the chief qualities of a Negotiable Instrument and seals its further debatability. This may sound somewhat unordinary, yet the endorsee is especially inside his privileges on the off chance that he so signs that its resulting move is limited. This forestalls the danger of unapproved individuals acquiring installment through misrepresentation or falsification and losing their cash.

A bank endorsement is a guarantee made by a bank that it will honor a payment agreement between one of its customers and a seller. Endorsement is defined as the act of giving your approval or recommendation to something, usually in a public manner. An example of an endorsement is when you sign the back of check, telling the bank that you give your approval for the check to be cashed. An endorsement alters the policy and becomes part of your authorized insurance contract. It stays in drive till the expiry of the coverage and may renew under the identical phrases and circumstances as the remainder of your policy. The exception to this is if the endorsement specifies a selected term which the endorsement is legitimate.

SEC Charges Kim Kardashian for Unlawfully Touting Crypto Security – SEC.gov

SEC Charges Kim Kardashian for Unlawfully Touting Crypto Security.

Posted: Mon, 03 Oct 2022 07:00:00 GMT [source]

Insurance endorsements are utilized in property and casualty insurance. Examples of endorse in a Sentence We do not endorse their position. When someone pays you with a check, it’s like handing you cash; but there are few more steps involved.

Signing the back of it is called “endorsing the check.” We have tips on how you can safely endorse a check. An endorsement is supposed to be a partial endorsement when the endorser indicates to move to the endorsee, just an aspect of the sum payable. In straightforward terms, support which permits moving to the endorsee an aspect of the sum payable is known as halfway underwriting. If you use your bank’s smartphone app or online system to deposit your check, it might be that you need to endorse it in a particular way. A few banks will require you to write “mobile deposit” if you use this method, so check your bank’s guidelines.

Pay to order refers to negotiable checks or drafts paid via an endorsement that identifies a person or organization the payer authorizes to receive money. An endorsement refers to a signature or an equivalent stamp that authorizes payment or a transfer of funds, as when an individual signs a check. Endorsements should be handled carefully to avoid that the check gets cashed by someone else different than the intended recipient. If a check is endorsed with just the signature and gets lost somehow a person different than the original beneficiary can endorse his own account number and deposit the check on his behalf. A way to avoid this situation would be to cancel that specific check as soon as it gets lost.

This assures any third-party that the bank will back the obligations of the creator of the instrument in the event the creator cannot make payment. One type of bank endorsement is a banker’s acceptance, also known as a time draft. The time draft must be originated and accepted by the bank of the person creating the draft.

How to Endorse a Check

Bank endorsement can also occur for domestic shipments within the United States. However, these trade-related endorsements are often used for international trade. The importance of endorsement of guidelines by professional bodies is also underestimated by the existing instruments. Class 4 contained 6 % of subjects with high endorsements of both mood and somatic symptoms, including both fatigue symptoms.

It’s often done by adding documents to your policy when an endorsement adds something, when it lists extra conditions, or when it adds restrictions or limits after underwriting by the insurance company. This is because the policy wording or contract isn’t changed, only these new terms. An endorsement, or «rider,» can be used to add, delete, exclude, or alter coverage. It can be issued during your policy term, at the time of purchase, or when you renew the plan. An endorsement is an amendment or special clause to a document or contract, an authorizing signature, or a public declaration of support. Specific types include insurance, signature, and license endorsements.

Typically, this type of endorsement increases the policy premium due to the added benefits to the policyholder and beneficiary and the increased risk to the insurer. Bank endorsements are guarantees from a bank that ensure it will uphold the commitments of its client. A bank will not provide a bank endorsement unless it can verify that both parties are trustworthy. A bank endorsement helps both parties feel confident they will have a trusted transaction. Bank endorsements are commonly used with international trade agreements.

- They may choose to limit coverages in the course of the term as properly.

- For instance, the endorsee is subject to pull out of disrespect to the endorser, and typically inability to pull out will vindicate the endorser from his risk.

- Here, the endorser gives up some right to which they have entitlement.

- Some bank endorsements also remove the need for financing a payment.

There is a heading endorsement meaning in bankinged by Endorsement to the individual indicated called the endorsee of the instrument who presently turns into its payee qualified to sue for the cash due on the instrument. Because endorsements provide extra security for your funds, most banks will be reluctant to take a check that has not been properly endorsed. Riders can be additional documents added to your policy, or they can replace your previous policy documents. The act is special or full when an endorser or transferor signs the instrument and writes the payee’s name too.

Here, the endorser gives up some right to which they have entitlement. For instance, endorsees are responsible for giving notice of dishonor to the endorser. In case they fail to provide this notice, the latter will be free from their liability. Besides knowing endorsement meaning, you must be aware of its different types. The opposite of a license endorsement is a restriction, which forbids certain behavior when driving.

This is important to keep in mind because if you lose the check after you endorse it, someone can steal the check and alter the endorsement. This method specifically instructs the bank that the check should be deposited into the account identified in the endorsement. Whether you are taking the check directly to the bank or if a friend is taking the check to your bank for you, we recommend that you use this method as a more secure option. If a check is made out to multiple people (i.e. multiple payees), look for “and” or “or” in the pay-to line. If the check is made out to “John and Jane Smith,” then John and Jane must both endorse the check.

An endorsement has different meanings, but most have to do with the concept of approval or authorization. Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning. Caroline Banton has 6+ years of experience as a freelance writer of business and finance articles.

Then, when you’re at the bank, you tell the teller if you want to cash it or deposit it. A blank endorsement consists simply of the signature of the person to whom the check is made out to on its back side. This makes the check negotiable tender for anyone holding it, not just the endorser, so it is not a very safe form of endorsement.

Dejar un comentario

¿Quieres unirte a la conversación?Siéntete libre de contribuir!