Comparison between Average True Range ATR, Average Day Range ADR, and Intraday Range IR

Contents:

Second, stock average true range only measures volatility and not the direction of an asset’s price. This can sometimes result in mixed signals, particularly when markets are experiencing pivots or when trends are at turning points. The Average True Range is a tool used in technical analysis to measure volatility. Unlike many of today’s popular indicators, the ATR is not used to indicate the direction of price. Rather, it is a metric used solely to measure volatility, especially volatility caused by price gaps or limit moves. TradingView provides some variations (in the indicator’s settings), such as using a simple moving average or an exponential moving average to calculate the average.

- Wilder created Average True Range to capture this «missing» volatility.

- In practice, the usual value given for n is 14 days or 14 periods.

- As such, ATR can be used to validate the enthusiasm behind a move or breakout.

- A rule of thumb is to multiply the ATR by two to determine a reasonable stop-loss point.

For gauging longer-term volatility, on the other hand, a 20 to 50-day moving average should be used. An average true range value is the average price range of an investment over a period. So if the ATR for an asset is $1.18, its price has an average range of movement of $1.18 per trading day. The first step in calculating ATR is to find a series of true range values for a security. The price range of an asset for a given trading day is its high minus its low.

Indicators Q ~ U

Because the ATR moves up and down over time, a low-volatility period should theoretically be followed by a period of higher volatility at some point in the future. Some traders might look for low ATR as an indication that the stock is about to break out . But the directional movement of the ATR doesn’t say anything about the direction of the price — it only measures how much the stock is moving. If a stock is already falling, an increasing ATR could signal a more severe price decline.

Together, these https://trading-market.org/ indicators can help paint a more complete picture when attempting to read a security’s buy or sell signals. The ATR technical indicator is a key tool for traders looking to understand volatility patterns in a particular market and make informed trading decisions. The average true range is a type of moving average that was developed in 1978 by American technical analyst J. He explained how to calculate the ATR in his book New Concepts in Technical Trading Systems. The ATR indicator moves up and down as price moves in an asset become larger or smaller. A new ATR reading is calculated as each time period passes.

The price has already moved 47% more than the average ($2.07), and now you’re getting a buy signal from this strategy. Day traders can use the information on how much an asset typically moves in a certain period for plotting profit targetsand determining whether to attempt a trade. Commodity and historical index data provided by Pinnacle Data Corporation. Unless otherwise indicated, all data is delayed by 15 minutes. The information provided by StockCharts.com, Inc. is not investment advice.

Example of Using ATR in Trading

As a volatility indicator, the ATR gives traders a sense of how much an asset’s price could be expected to move. Used in tandem with other technical indicators and strategies, it helps traders spot entry and exit locations. As such, the ATR is a valuable tool for providing traders with entry and exit points. While calculating an investment’s ATR is relatively simple, still, employing this indicator alongside other technical analysis devices is highly recommended.

- A high ATR implies high price volatility during the given period, and a low ATR indicates low price volatility.

- Of course, you might occasionally start your jump from behind the line.

- Besides the Average True Range indicator, he also invented the Relative Strength Index , the Average Directional Index and the Parabolic SAR.

- These types of charts are useful as traders can use the charts to identify entry and exit points for their positions.

But if the previous close was outside this range, that level can be used in place of the daily high or low. For example, if a stock price had a daily low of $8 and a daily high of $10, its range would be $2 (between $8 and $10). Instead of 14 days, analysts can use a different timeframe for periods (e.g., weekly, monthly, annually) or even a different number of periods.

Strategy—ATR Trailing Stop Loss 💨

It is a good option when trying to gauge the overall strength of a move or for discovering a trading range. That being said, it is an indicator which is best used as a compliment to more price direction driven indicators. Once a move has begun, the ATR can add a level of confidence in that move which can be rather beneficial. As ATR only measures price volatility, it doesn’t inform traders of the change in an asset’s price direction. One example is when there is a sudden increase in ATR, some traders might believe it is confirming an old upwards or downwards trend, which can be false. The average true range line on a chart rises as volatility increases and falls as volatility declines.

Using the Average True Range (ATR) Indicator in Your Trade Exit Strategy – The Ticker Tape

Using the Average True Range (ATR) Indicator in Your Trade Exit Strategy.

Posted: Tue, 26 Jul 2022 07:00:00 GMT [source]

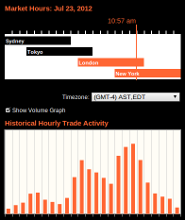

IR is more detailed than ADR, but they are basically showing the same thing. IR shows volatility data for each price bar, with the option to add an average . In TradingView, hover over the indicator name, and click the three dots. Choose “Add Indicator” and add a moving average to see an average of the data.

Technical Analysis: how to use the Average True Range Indicator?

Afinancial advisorcan help you develop an understanding of investment terms and strategies as well. Futures or forward contracts are very popular derivative products to trade within the commodities market, as well as for forex pairs or stock indices. The average true range indicator can be used to approximate the size of the trade that traders should place for a specific commodity or asset. In a futures strategy, traders should assess the volatility of the market and consider their risk management options.

Every measure of volatility provides different information and insight, and there is no single best tool to use. Traders often combine several pieces of information to develop a forecast of what will happen next. For example, assume a stock is trading around $40 and that the highest price in the last three weeks was $43, with an ATR of $2.

Trading signals occur relatively infrequently but usually indicate significant breakout points. The logic behind these signals is that whenever a price closes more than an ATR above the most recent close, a change in volatility has occurred. An expanding ATR indicates increased volatility in the market, with the range of each bar getting larger.

Comparison between Average True Range (ATR), Average Day Range (ADR), and Intraday Range (IR)

In any case, a trader might want to investigate why a security has an unusually high ATR before they buy or sell. For example, many analysts argue the Biden administration’s infrastructure plan could cause industrial stocks to surge. Analysts can’t learn much from the range of a single interval. A single-interval range imparts as much data as an oarless rower provides power. Analysts need a fully-equipped crew, so they find the true range of several intervals and calculate the average.

I don’t find ATR useful as a day trader because it includes gaps. Since day traders don’t hold overnight, indicators that include gaps are not accurate and/or don’t identify the volatility that actually occurs while the day trader is trading. If using a daily chart, then the intraday range is calculated.

The S&P 500 Is at an Inflection Point: Will Bulls or Bears Gain the … – RealMoney

The S&P 500 Is at an Inflection Point: Will Bulls or Bears Gain the ….

Posted: Tue, 28 Feb 2023 08:00:00 GMT [source]

14 is commonly used and is the default in most charting software. In this article, I’ll go over each of these indicators, how they are calculated, and how they can be used. No BS swing trading, day trading, and investing strategies.

The descriptions, formulas, and parameters shown below apply to both Interactive Charts and Snapshot Charts, unless noted. Please note that some of the parameters may be slightly different between the two versions of charts. A market will usually keep the direction of the initial price move, though this is certainly not a rule. During periods of little volatility, the ATR decreases in value.

It is a measure of volatility used in technical analysis . The range of any day’s price movements is the difference between the highest and the lowest trading price of the day. It usually represents the 14-day moving average of the difference between the daily high and low price.

It is best used to determine how much an investment’s price has been moving in the period being evaluated rather than an indication of a trend. Calculating an investment’s ATR is relatively straightforward, only requiring you to use price data for the period you’re investigating. The indicator calculates the market’s average price of assets within a 14-day range.

For example, we can subtract three times the ATR value from the highest high since entering the trade. If using a different time frame, then the intra-bar range is calculated. A 1-minute chart will show the total movement between high and low for that one-minute candle.

However, it is useful to understand how to calculate the average true range, to make informed decisions about which settings to use for your trading strategy. The ATR typically calculates volatility over days, but it is also used to analyse intraday, weekly, or monthly volatility. After the spike at the open, the ATR typically declines most of the day. The oscillations in the ATR indicator throughout the day don’t provide much information except for how much the price is moving on average each minute.

Understanding how the two compare can help you determine which strategy may work best, based on your investment goals and risk tolerance. It is a subjective measure that is open to interpretation. No single ATR reading will clearly indicate whether a trend is about to reverse. Therefore, traders always compare ATR values with earlier readings for indications of the strength or weakness of a price trend. Once you have the TR and prior ATR, you calculate the current ATR from Wilder’s formula to smooth out the data with a moving average. To make the right trading decisions, a trader should understand how their favourite indicator is created.

Dejar un comentario

¿Quieres unirte a la conversación?Siéntete libre de contribuir!